Datametrex AI's blockchain, machine learning, big-data, and crypto mining divisions poised for spectacular growth

Datametrex AI Limited is an exceptional data blockchain/business intelligence stock, and has an industrial scale cryptocurrency mining division backed by Gosun.

Datametrex AI Limited (TSX:DM)

NEW YORK, NY, UNITED STATES, February 27, 2018 /EINPresswire.com/ -- Datametrex AI Limited (TSX-V: DM) (FKT:D4G) (OTC: DTMXF) appears set to outperform the data blockchain and business intelligence sectors; it has growing revenues in AI/Machine Learning with Federal Government contracts, has contracts for blockchain prototypes including a partnership with IBM to build a blockchain prototype for a Korean utility, plus its cyrptocurrency mining division (which Datametrex just announced it plans to spin-out as a standalone public listing) has access to 140Mw of power (capable of powering up to 70,000 rig servers) with Gosun.

Datametrex AI Limited is a Canadian-based technology focused company with exposure to four exciting verticals;

- Artificial Intelligence and Machine Learning through its wholly owned subsidiary, Nexalogy (www.nexalogy.com).

- Implementing Blockchain technology for secure Data Transfers through its joint venture company, Graph Blockchain (www.graphblockchain.com).

- Industrial scale Cryptocurrency Mining through its wholly owned subsidiary, Ronin Blockchain Corp (www.roninblockchain.com).

- Big Data, collecting data from retail point of sale environments.

Each division is early in its lifecycle, and ripe with potential for scale. Datametrex's share price is poised for significant upside revaluation as its current market cap (~C$46 million, DM.V trading at ~C$0.23) appears disproportionate relative to the sum of each divisions potential. Datametrex AI Limited was launched in the later-half of 2017 with the intent of DM.V being a vehicle for attracting some of the most unique cutting-edge technology businesses poised for break-out and individuals at the fore of their fields. The result is a targeted yet diversified approach that offers shareholders exposure to the hottest up-and-coming sectors of the new economy.

Datametrex's objective is to facilitate each division, so they are in a position to execute and hit milestones, by providing them the tools in their toolbox to build out the businesses, whether that be capital or introduction to new clients. Spearheading Datametrex's management team is Chairman & CEO Andrew Ryu, COO & President Jeff Stevens, and Chief Strategy Officer Michael Frank, all are highly experienced in the capital markets, and have several decades of success under their belt in the public markets. This management team is known for recognizing opportunity, moving quickly, their ability to raise capital, and structure deals.

The following is a synopsis of each division, in the order they were acquired/incepted, and why valuation is apt to rise.

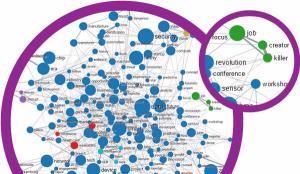

1) Nexalogy Environics Inc. - Artificial intelligence and machine learning (a 100%/wholly-owned subsidiary of Datametrex): Nexalogy's technology is unlike anything that exists and is attracting increasing high-level federal government attention/contracts, this division has growing revenues. Nexalogy has NDAs that prevent disclosure of client specifics, however we do know Datametrex currently has 3 Federal Government agency contracts, and has stated it is targeting/involved with government agencies in security, health & safety, and public-Canada. Nexalogy has software and systems with the ability to scour the vast web of social media and detect weak signals/anomalies behind the noise, identify unknowns, and generate customized actionable intel for clients. Nexalogy is on target for ~C$2.5M+ in revenues for 2018 (up from ~$1.5M in 2017), and within a few years it is conceivable to see an increase to >$40M revenues.

The social media analytics market is forecast to grow to US$5.4 Billion by 2020. Clearly the sum of the parts of Datametrex is greater than the whole, it is not unreasonable for investors to attribute a ~C$40+ million valuation now (on to much higher from there) for the Nexalogy division alone, based on where this is headed.

2) Graph Blockchain Limited (Planned spin-out): Graph specializes in implementing custom blockchain technology for secure data transfers for corporations and government agencies. Graph is a spinout that Datametrex is planning for 2018 that is expected to see shareholders of DM.V receive 1 share of Graph Blockchain Limited for every 20 they hold of DM.V. (the record date not been set yet, look for guidance on this soon). Datametrex corporately will also retain a ~20% interest in the new publicly traded entity, the whisper number on Bay Street is that Graph Blockchain Limited will IPO at ~C$35 Million market cap (which would give DM.V's 20% retained interest an intrinsic value of C$8M). Graph has already been sufficiently financed with a recent seeding of $3.5M (proceeds to be used to build its Graph Blockchain solutions), and thus it is likely only a very nominal financing will accompany the IPO for the main purpose of establishing price only. Graph is a 50-50 joint venture (JV) Datametrex started with San Francisco-based Bitnine which has vended-in its cutting-edge Graph Database technology.

Graph's technology processes blockchain data up to 1,000 times faster than traditional methods and is 10,000 times faster at presenting data from the blockchain to the dashboard.

Currently Graph is contracted to develop a blockchain solution prototype in partnership with IBM for a Korean conglomerate's utility for US$400K. This ~US$400,000 contract for the prototype, if successful (and there is no indication it will not be successful), we anticipate will turn into a full-scale multi-million dollar project for Graph.

Graph is also under contract with a medical marijuana client to facilitate a blockchain solution for clinical trails.

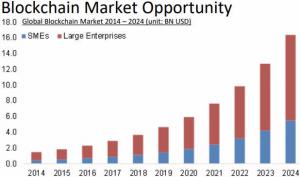

The global blockchain market is a megatrend and only just beginning. Expect Graph Blockchain Limited to announce additional contracts as 2018 progresses as the level of discussion for its solutions runs high.

3) Ronin Blockchain Corp. - Industrial scale cryptocurrency mining targeting 140Mw, 70,000 rigs (a 100%/wholly-owned subsidiary of Datametrex): Ronin’s business model is based on a centralised AI powered mining platform to operate a geo-diversified footprint of industrial scale blockchain mining operations.

The following URLs have been identified for additional DD on Datametrex AI Limited:

Corporate webpage: https://www.datametrex.com

Recent Technology Journal Review:

http://technologymarketwatch.com/dm.htm

Content herein is for information purposes and is not a solicitations to buy or sell any of the securities mentioned.

Fredrick William

Technology MarketWatch Journal

8666209945

email us here

EIN Presswire does not exercise editorial control over third-party content provided, uploaded, published, or distributed by users of EIN Presswire. We are a distributor, not a publisher, of 3rd party content. Such content may contain the views, opinions, statements, offers, and other material of the respective users, suppliers, participants, or authors.